A straitjacket is where this man and his followers belong. And where Bush before him should have been placed. For as much as the beaus and bimbos of FoxNews and their loyalists wish to forget, Bush paved the way for Barack’s Bacchanalia—“The unconstitutional campaign finance-reform bill and ‘Sarbanes-Oxley Act’ (a preemptive assault on CEOs and CFOs, prior to the fact of a crime); the various trade tariffs and barriers; the Clintonian triumph of triangulation on affirmative-action; the collusion with Kennedy on education; the welfare wantonness that began with a prescription-drug benefit that would add trillions to the Medicare shortfall, and culminated in the Kennedy-countenanced ‘New New Deal’ for New Orleans, for which there was no constitutional authority; the gold-embossed invitation to illegals to invade, and the ‘camouflaged amnesty'”—Barack wishes he’d done all this, but these were Bush’s babies.

Back to the bastard du jour : The New York Times editorializes approvingly on what Obama’s health care “reform” will accomplish:

It will “require virtually all Americans to carry health insurance or pay a penalty. And it would require all but the smallest businesses to provide health insurance for their workers or pay a substantial fee. It would also expand Medicaid to cover many more poor people, and it would create new exchanges through which millions of middle-class Americans could buy health insurance with the help of government subsidies. The result would be near-universal coverage at a surprisingly manageable cost to the federal government.

The nonpartisan Congressional Budget Office estimates that by 2015, 97 percent of all residents, excluding illegal immigrants, would have health insurance. The price tag for this near-universal coverage was pegged by the budget office at just more than $1 trillion over 10 years — at the low-end of the estimates we’ve heard in recent weeks.

The legislation would pay for half that cost by reducing spending on Medicare, a staple of all reform plans. It would pay for the other half by raising $544 billion over the next decade with a graduated income surtax on the wealthiest Americans: families with adjusted gross incomes exceeding $350,000 and individuals making more than $280,000.” …

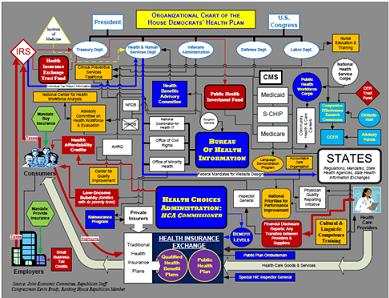

Update I: Republicans on the Joint Economic Committee (led by Rep. Kevin Brady (R-TX), who, as far as I know, did less than nothing to highlight the evils of their Boy Bush’s prescription drug program, have developed the following organizational chart to illustrate the efficiencies built into to the Democrats’ healthscare politburo. Since the image, never the program, is quite small, check it out here.

Update II (July 17): “In total, CBO estimates that enacting [Obama’s healthscare) provisions would raise deficits by $1,042 billion over the 2010-2019 period.” But the CBO and the JCT hope that the net increase in the federal budget deficit of enacting H.R. 3200 will be only a meager $239 billion over the 2010-2019 period. That’s because of some “savings” the Act affords.

“That estimate reflects a projected 10-year cost of the bill’s insurance coverage provisions of $1,042 billion, partly offset by net spending changes that CBO estimates would save $219 billion over the same period, and by revenue provisions that JCT estimates would increase federal revenues by about $583 billion over those

10 years.”

Douglas W. Elmendorf, Director of the CONGRESSIONAL BUDGET OFFICE, who conducted the analysis of “H.R. 3200, America’s Affordable Health Choices Act of 2009,” summarizes the Act’s mandates:

The legislation would establish a mandate to have health insurance, expand eligibility for Medicaid, and establish new health insurance exchanges through which some people could purchase subsidized coverage. The options available in the insurance exchange would include private health insurance plans as well as a public plan that would be administered by the Secretary of Health and Human

Services. The specifications would also require payments of penalties by uninsured individuals, firms that did not provide qualified health insurance, and other firms whose employees would receive subsidized coverage through the exchanges. The plan would also provide tax credits to small employers that contribute toward the cost of health insurance for their workers.

I must say, I’m quite impressed with the CBO. Just the facts, ma’am.

Update III (July 18): Warns economist Peter Schiff: “the economy is walking dead anyway, and this measure is the equivalent of a stake through the heart.” From “Prescription for Disaster”:

“[T]taxing the rich to pay for health care for the uninsured is the wrong way to think about tax policy and is an unconstitutional redistribution of wealth. While the government has the constitutional power to tax to “promote the general welfare,” it does not have the right to tax one group for the sole and specific benefit of another. If the government wishes to finance national health insurance, the burden of paying for it should fall on every American. If that were the case, perhaps Congress would think twice before passing such a monstrosity.

In the second place, the bill is just plain bad economics. For an administration that claims to want to create jobs, this bill is one of the biggest job-killers yet devised. By increasing the marginal income tax rate on high earners (an extra 5.4% on incomes above 1 million), it reduces the incentives for small business owners to expand their companies. When you combine this tax hike with the higher taxes that will kick in once the Bush tax-cuts expire, and add in the higher income taxes being imposed by several states, many business owners might simply choose not to put in the extra effort necessary to expand their businesses. Or, given the diminishing returns on their labor, they may choose to enjoy more leisure. More leisure for employers means fewer jobs for employees.

More directly, mandating insurance coverage for employees increases the cost of hiring workers. Under the terms of the bill, small businesses that do not provide insurance will be required to pay a tax as high as 8% of their payroll. Since most small businesses currently could not afford to grant 8% across-the-board pay hikes, they will have to offset these costs by reducing wages. However, for employees working at the minimum wage, the only way for employers to offset the costs would be through layoffs.”

Read the complete column on Taki’s.