By MYRON PAULI

MYRON PAULI explains what separates Steven Jobs, the quintessential “Homo Aynrandis,” from Homo Corporatist, that atavistic throwback that manages the typical corporation nowadays.

ONCE UPON A TIME, great men like the late Steven Jobs (Homo Aynrandis) roamed about in our early republics (note the plural – each state has a republican form of government) – men like Morse, Fulton, Edison, Whitney. These were creators and innovators who helped mankind by helping themselves – not because some bureaucrat put a gun to their heads. They made money through their inventiveness and vision, not by “manipulating the system.”

Nearly all of these early Howard Roarks (the hero in Ayn Rand’s Fountainhead) were self-educated. They made their fame and fortune in spite of “the system.” College dropout Jobs was one of these great men and let us hope not the last.

Nowadays, we have a different species of capitalist, Homo Corporatist, “managing” most companies – usually for personal gain and short-term profit – into oblivion. They are often spoiled rich kids who smoke dope through college and then get educational “credentials” in “management” and economics from neo-Marxist pedagogues teaching Keynes, Krugman, Samuelson etc. These corporate-technocratic-idiot-savants work their way into companies, sucking up to the vampires who mismanage these companies, and then get hired as CEOs.

Jobs made that mistake in hiring John Sculley from Pepsi and the soda salesman soon manipulated Jobs out of Apple. Later Apple sued Jobs, whose quote, “It is hard to think that a $2 billion company with 4,300-plus people couldn’t compete with six people in blue jeans,” says all one needs to know about those characters and the modern era.

But Jobs was down but not out. He made Next and Pixar and out-Appled Apple until they took him back and resumed growing. The alternative for Apple would have been to hire the type of corporate flacks who have mismanaged General Motors for the last 70 years.

As for Homo Corporatist – they are excellent in claiming hundreds of millions of dollars in bonuses while their companies slide into oblivion. Thomas Edison founded General Electric whose products were found in nearly every American home – now the company is “managed” by Harvard M.B.A. Jeffrey Immelt. Instead of watching GE televisions, Americans now watch GE’s Rachel Maddow spouting inane nonsense on Korean televisions. GE has become a bubble-manipulating finance company which lobbies for tax breaks and “green energy mandates” from its political buddies.

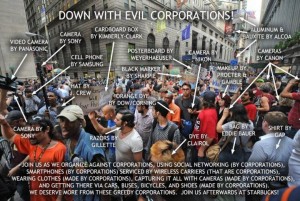

Homo Corporatist, sadly, is ubiquitous. In China and Russia, they are the children of the old party apparatchiks who now play “businessman” in a fascist economy. In the Arab world, they are the relatives and friends of the King/Sheik/Dictator now operating various “enterprises.” In America, it is Archer Daniels Midland with their agribusiness “ethanol mandates.” It is people like my Senator, Mark Warner, who made money off the FCC monopolistic licenses. It is people like Merrill Lynch’s Stan O’Neal, an egomaniac who had security guards holding an entire elevator bank open for him and ran off with well over $100 million, while sinking “bullish” Merrill with subprime mortgages before moving on to Alcoa whose stock has also tanked.

Most of these managers know less about the products that the companies make than their janitors. They make short term profits by firing research staff, selling ideas and marketing opportunities overseas, and finding quick-fix gimmicks, as they pocket the bonuses, and lobby against competitors – and like good vampires, move on to the next target. Some might be better than others – but can Herman Cain (Federal Reserve Bank leader) cook a pizza??

At my first company after graduate school, the big shots were shorting their own stock to the Employee’s Stock Plan (!); they paid 20 percent to borrow money in 1982 to buy up a company at over 50 times price-to-earnings, and then sacked most of the company, bribed government officials and covered it up, then pleaded “no contest” to the bribes with some leaving the companies with golden-parachute bonuses while the “lower animals” at the company got furloughs and had to take ethics training to not do what the big shots had done – all while the company stock plummeted from 45 to 3! While my years in the employ of the government reinforce my libertarianism, I could see how people in companies like this could wind up as Marxists!

Steven Jobs, Homo Aynrandis, will be missed. He was what capitalism should be about.

**

MYRON PAULI, Ph.D., grew up in Sunnyside Queens, went off to college in Cleveland and then spent time in a mental institution in Cambridge MA (MIT) with Benjamin Netanyahu (did not know him), and others until he was released with the “hostages” and Jimmy Carter on January 20, 1981, having defended his dissertation in nuclear physics. Most of the time since, he has worked on infrared sensors, mainly at Naval Research Laboratory in Washington DC. He was NOT named after Ron Paul but is distantly related to physicist Wolftgang Pauli; unfortunately, only the “good looks” were handed down and not the brains. He writes assorted song lyrics and essays reflecting his cynicism and classical liberalism.