WIN OR DIE, DUMMIES is what Ukrainians are being instructed by the US, its NATO marionettes and the treacherous leader Zelensky, who is protected by the aforementioned forces ~ilana

The depravity—the immorality—of Ukraine’s America-engineered existential reality … ~ilana

Four minutes and 21 seconds into his YouTube interview with Aaron Mate, John Mearsheimer, a utilitarian political scientist, says this: “Secretary General of NATO, Jens Stoltenberg, made it clear that Ukraine would not be admitted into NATO until it had prevailed in the conflict [with Russia].”

Mearsheimer addresses the purely pragmatic, utilitarian aspect of the reality into which Ukraine was thrust. It cannot win the war with Russia. Therefore, deduces Mearsheimer, Ukraine will not be brought into the NATO alliance.

True. This much we all knew.

WIN OR DIE, DUMMIES

UPDATE (8/3/023): This depravity—the immorality—of Ukraine’s America-engineered existential reality was seconded by one Dan Sullivan, Republican representative from Alaska.

Following a recent NATO Summit, which, naturally, determined that US stooge and puppet Ukraine would not be rewarded with NATO membership—the Fix News outpost, another fount of establishment deceit, entertained Sullivan for a comment.

Sullivan—with a demented grin you’d expect to see on a patient with end-stage syphilis (a career-destroying line I used on Genghis Bush in 2003)—offered that Ukraine has not won yet. The question was not Ukraine’s admission into NATO, said this Republican reptile; the question was winning against Russia.

WIN OR DIE, DUMMIES is what Ukrainians are being told by the US, its NATO marionettes and the treacherous leader Zelensky, who is protected by the aforementioned forces.

UPDATE III (8/8/023): August 7 was Joni Ernst’s time to make the fur fly. (Cynicism alert.) Ernst, Republican representative from Red Oak, Iowa, proves, in the end, that it is as Dr. Johnson said: “There is no settling the point of precedency between a louse and a flea.” Neoconservative or neoliberal; louse or flea, a pest is a pest.

The words of this particular political pest were the as follows:

Once Republicans explain to us, Americans, the nature of the mission to Iraq, oops, Ukraine—yes, where have I heard such GOP Machiavellian talk before? Rhetorical—we The People will get behind the mission.

“Shock-‘n-awe of the old days,” said Ernst, will garner support for the war in Ukraine.

Oh, and, if this following cliche is new to you: Ernst thinks that our “adversaries do not fear us.” No worries, Ernst. On August 5, also on Fox News, Victor Davis Hanson critiques Obama for the few good things 44 did: returning to Iran monies stolen by the American government. Diplomacy with Russia.

VDH has been avidly cheering for the Ukrainian project—and seems unable to quiet his rhetoric about American foreign-policy Manifest Destiny. His first instinct was to support the Ukrainian endeavor and he holds the most mundane neoconservative views on Russia. Being Neocon, wrong and immoral earns America’s pundits plaudits aplenty.

The tête-à-tête between these two effetes—Fox News’ interchangeable anchor and Sullivan, archetypal Republican—revealed a tidbit that backs my longtime theorizing about Canada: That country is not too serious about tyranny. Canada makes noises about following Uncle Sam. It badly wants to be the USA when it grows up. But it always falls flat. Kudos. Thus, talk aside, Canada contributes minuscule sums to NATO.

In any case, the depravity—the immorality—of Ukraine’s America-engineered existential reality is that, the United States, via its NATO front, has used Ukraine, mercilessly dangling NATO membership before this poor nation, to attempt to dislodge Putin. Putin is a reactionary Russian patriot, natural ally of any sovereign, conservative nation-state. The radical American objective is to make Russia over in the image of America: an abiding Jacobin stronghold at heart.

UPDATE (8/4/023): As this writer remarked in commentary about “America’s radical, foreign-policy Alinskyites, in March, 2021, “Certain national-conservative governments in East Europe should be natural allies to conservative policy makers, stateside, if such unicorns existed. Vladimir Putin’s, for example. Before his death, Aleksandr Solzhenitsyn, one of Russia’s bravest and most brilliant sons, praised Putin’s efforts to revive Russia’s traditional Christian and moral heritage. For example:

In October 2010, it was announced that The Gulag Archipelago would become required reading for all Russian high-school students. In a meeting with Solzhenitsyn’s widow, Mr. Putin described The Gulag Archipelago as ‘essential reading’: ‘Without the knowledge of that book, we would lack a full understanding of our country and it would be difficult for us to think about the future.’ …

If [only] the same could be said of the high schools of the United States. (Via The Imaginative Conservative.)

For a long while, the Russian president patiently tolerated America’s demented, anti-Russia monomania. And, as America sank into the quicksands of what Cons call “Cultural Marxism”—I, since the get-go, have framed the new Western dispensation as anti-Whiteness—Putin’s inclinations have remained decidedly reactionary and traditionalist.

He prohibited public sexual evangelizing by LGBTQ activists. He comes down squarely on the side of the Russian Orthodox church, such as when vandals, the Pussy Riot whores, obscenely desecrated the cathedral of Christ the Savior. The Russian leader has also welcomed as refugees persecuted white South Africans, where America’s successive governments won’t even officially acknowledge that they’re under threat of extermination. Also, policies to stimulate Russian birthrates have been put in place by the conservative leader.

The command-and-control US Media have purged any news of peace talks with Russia. “Peace” is a dirty word in the Western Warfare State, for “war is the health of the state.” Ukraine, for its part, is led by a vainglorious fool. “Zelensky is a kept man, his flesh softer than sin under the khaki costume.” For all his Jewish-lineage boasts, Zelensky ought to know that, “It’s biblical. “A leader who fails to haggle for the lives of his people is a failed leader.”

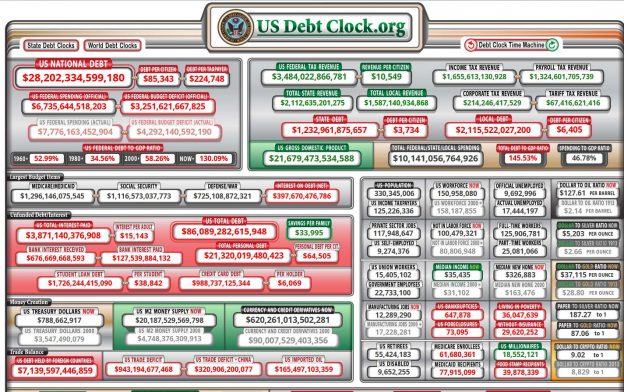

So, it has been ordained that Ukraine be destroyed on the alter of the imploding, degenerate, morally and fiscally bankrupt American Empire and its European zombie satellite states.

Articles Archive: https://www.ilanamercer.com/category/ukraine/

1. Neocons, Neolibs And NATO Inch Us Closer To Nuclear War With Russia, 01/29/2022: https://www.ilanamercer.com/2022/01/neocons-neolibs-nato-inch-us-closer-nuclear-war-russia/

2. Uncle Sam Still King Of All Invaders: Ukraine, Realpolitik And The West’s Failure: March 3, 2022 https://www.ilanamercer.com/2022/03/uncle-sam-still-king-invaders-ukraine-realpolitik-wests-failure/

3. True Story: Russia Finds WMD In Ukraine! March 10, 2022 https://www.ilanamercer.com/2022/03/true-story-russia-finds-wmd-ukraine/

4. It’s Biblical, Zelensky: A Leader Who Fails To Haggle For The Lives Of His People Has Failed https://www.ilanamercer.com/2022/03/biblical-zelensky-leader-fails-haggle-lives-people-failed/

5. U.S. Cancels Countries, Kills Ancient, Civilizing Concept Of Neutrality April 7, 2022 https://www.ilanamercer.com/2022/04/u-s-cancels-countries-kills-ancient-civilizing-concept-neutrality/

6. Ukraine’s Azov Battalion: Nazis Or Just Nationalists? May 12, 2022 https://www.ilanamercer.com/2022/05/ukraines-azov-battalion-nazis-or-just-nationalists/

7. “The D-Bomb, Realpolitik, Zelensky’s Self-Serving ‘Heroics’ & What ‘Mixed-Race’ Really Means” December 22, 2022 https://www.ilanamercer.com/2022/12/the-d-bomb-realpolitik-zelenskys-self-serving-heroics-what-mixed-race-really-means/

8. “Oh, What Wonderful Wars: The West’s Lying Warlords,” March 10, 2023

Mercer “Hard Truth” Video Podcasts on Ukraine. Please Subscribe:

https://rumble.com/c/HardTruthPodcast

https://rumble.com/vx058f-true-story-russia-finds-wmd-in-ukrainehtml

https://rumble.com/vw897h-russia-to-us-on-ukraine-pot.-kettle.-black..html

https://rumble.com/vtea18-neocons-neolibs-and-nato-inch-us-closer-to-nuclear-war-with-russia.html

“Ukraine’s Azov Brigade: Nazis Or Just Nationalists?”

“The US Plan To Bleed Russia Dry”

“Steamrolled By The Abrams: Republican Cretins Swallow Classified-Doc Bait”

“Oh What Wonderful Wars: The West’s Lying Warlords”

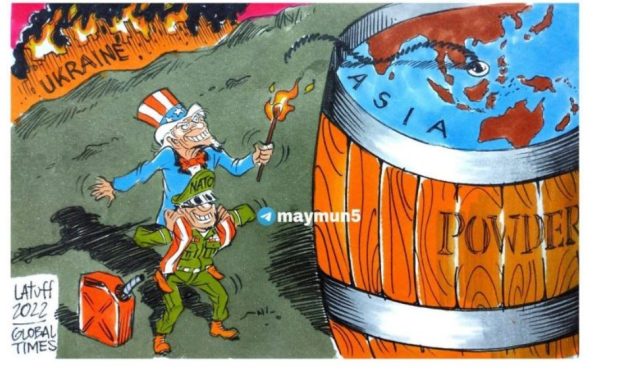

* Image captured as screen picture, courtesy Latuff, 2022, Global Times, here