State ideology and the corporate creed have converged. Between them, they suborn the individual in one way or another ~ilana

Between the State and the Corporation, Homo sapiens has been reduced to a Hobbesian, hedonistic version of homo economicus and a sad iteration of homo solitarius ~ilana

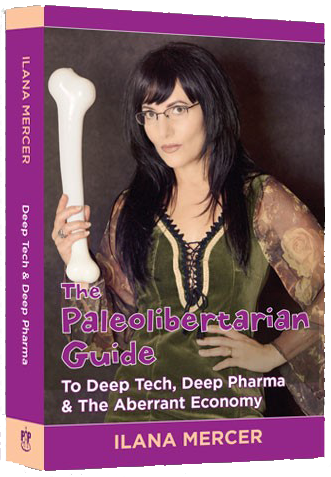

The Paleolibertarian Guide To Deep Tech, Deep Pharma & The Aberrant Economy is the first in a series of volumes, to form part of “The Paleolibertarian Guide” (TPG) compendium.

“DEEP TECH,” my preferred term for the high-tech sector, denotes how deeply the head honchos of high-tech have penetrated and poisoned the American public and private sectors. As a coinage, Deep Tech is superior to Big Tech. Drawn from the term “Deep State,” the term “Deep Tech” better captures Big Tech’s overarching, enervating and tentacular reach into state and civil society.

“Deep State,” of course, is no conspiracy. Before the Left turned the term against the Right; it had long since been deployed on the Left and by libertarians to denote the state within a state, operating, for the most, extra-constitutionally. To all intents and purposes, Deep Tech has become almost as powerful as the State in molding the Little Guy into a right-thinking Global Citizen.

In The Paleolibertarian Guide To Deep Tech, Deep Pharma & The Aberrant Economy, I make the case that state ideology and the corporate creed have converged. Between them, they suborn the individual in one way or another. The State no longer merely silhouettes civil and commercial society; but is absorbing it. What’s more, corporate culture, my purview in this volume, has been thoroughly co-opted by the State. Willingly so.

It has become the reflexive habit of corporations, not necessarily malevolently, to work together as well as to collude with government, to snuff out all lineaments of subversion in labor. After all, the progressive ideology is a gospel which these industry leaders never cease to proclaim and act upon. And if you fail to conform to it; they’ll fire you, isolate you, expose you, silence you, cancel you for good. These observations apply across party-lines.

“THE ABERRANT ECONOMY” in this work denotes the attitude of the multinationals toward economic growth. This attitude is today rooted not in healthy, community-based practices stateside and abroad, but in some aberrant economic gigantism. The derogatory diagnosis of economic elephantiasis undergirded by hubris, greed, and devout woke religiosity is warranted, I believe. Acromegaly is a physical deformity. In the human body it is caused by overproduction of certain compounds and is characterized by aberrant enlargement of the structure under discussion.

A diagnosis of economic acromegalia in Deep Tech is warranted ~ilana

The economic acromegalia or giantism diagnosed here in Deep Tech is one that manages to trample individual rights and other elementary decencies. Let us thus not confuse the metastatic multinational, motivated mostly by stratospheric wealth and a woke worldview—itself a gutter-like philosophy—with a business propelled by the good old-fashioned profit motive, whose growth is sustained by individuals and families tethered to corporeal communities, as opposed to colonies of imported laborers. Individuals, families, living in authentic, organic communities: These misty attachments are anathema to, and enemy of, the multinational’s clubby elites.

I underscore, as if in red ink, and deconstruct in detail how the awfulness of the COVID years, in particular, was underwritten by giant government, Big Pharma, and its latest malignant offshoot, the COVID Cartel—Disease X ad infinitum, if you will—in informal cahoots with social media. Again, a state within a state, operating, for the most, extra-constitutionally.

Just how control is achieved—more reflexively than conspiratorially—I demonstrate by taking the reader through the COVID years, when “Agency And State Capture” were consolidated. I show how and why the Grand Old Party, Republicans, will always be missing in action on matters of individual and constitutional rights. On all matters, actually:

The overtone window alludes to a range of ideas once considered unthinkable, but now normalized. With their flaccid, crushingly stupid responses to most situations—Republicans have helped to normalize tyranny ~ilana

And I touch on the deformed foundations of the American Third-Party run healthcare system, down to how Deep Pharma’s patent privileges subvert market-based profits and free market medicine. Fault Deep Pharma, I counsel, not China.

In fact, not mere jobs, but “the very stuff of life is outsourced” by High-Tech, which loathes a labor market. (Chapter 7.) After reading “Homeless In The Homeland” (Chapter 6), the most heartbreaking of the book’s chapters, the reader will understand not only how “High-Tech Compounds Homelessness,” but that “homelessness in the United States is both physical and metaphysical”:

When your home belongs to The World; it’s everybody’s home, and nobody’s home, not even yours, which means you could find yourself homeless ~ilana

Ultimately, the sundering of cherished natural and constitutional rights by entities whose market penetration and capitalization equal those of many countries combined is why a solution is urgent.

Free-traders such as myself contend that it is worse than corrosive for big, powerful business to usher in a mind-controlling creed which they enforce against the Little Guy—on pain of social and financial demise—so that his speech is confined to politically correct, do-or-die guiding lodestars, the kind that sap and leach away the individual’s native power. Such an immoral drive ought to have miscarried a long time ago. A solution is provided in Chapter 9, “Dispatching Deep Tech; Enforcing Natural Rights.”

In the “Epilogue: On Globalism & Giving,” I round up by juxtaposing global integration with regionalism and localism, and spotlighting the last inspirational capitalist heroes of international standing. I hope to leave the readers with thoughts about charity, grace and what distinguishes The Good Giver from the Showy Giver.

THE PHILOSOPHICAL FRAMEWORK

Analytical thinking precedes empiricism and is at the root of solid thought as well as good science ~ilana

The Paleolibertarian Guide To Deep Tech, Deep Pharma & The Aberrant Economy, as mentioned, is the first in a series of volumes, to form part of The Paleolibertarian Guide (TPG) compendium. The TPG’s polemical impetus is analytical in nature. The framework of this and future works in the series will systematically demonstrate that analytical thinking precedes empiricism and is at the root of solid thought as well as good science—and liberty itself.

To wit, certain propositions in life need no “empirical evidence” for their validation. If anything, the constant insistence on scientism is in itself evidence of a deep corruption of reason. While solid empirical data are never to be dismissed, these are supplemental to a solid philosophy of science.

Derived from the Aristotelian method, the method I follow, Austrian-School thinking, is based in the laws of reason. To the extent that research contradicts reason, to that extent research is rubbish. The idea that science without the philosophy of science is nonsense comes alive for readers in Chapter 2: “COVID’s Cartel Of Cretins,” where, vivid and fun examples of a priori truths are provided.

THE MOST IMPORTANT LESSON of this volume and those to follow is how to repatriate thinking outsourced to the expert class. For, these days, the simplest of logical deductions often appear to evade the ordinary man or woman.

The cognitive class, a managerial malignancy now glommed onto the Managerial State, will often cloak itself in the raiment of “science” and is instrumental in generating consensus. The insidious Expert Class that shapes and manages perceptions about public affairs I see as an extension of James Burnham’s Managerial State.

New Yorker James Burnham (1905-1987) began his intellectual odyssey as a Trotskyist before abjuring Marxism altogether and becoming a passionate anticommunist. He coined the phrase “managerial revolution,” which was extremely influential in the 1940s, and which served as the title of his bestselling book, one that had a marked impact on Orwell’s philosophy.

Lilliputian Man now finds himself pinned down like a butterfly, incapable or unwilling to derive and arrive at the truth without outsourcing his thinking to some authority or another. Restore we must the ancient philosophical notion whereby some things are simply axiomatically true (or false, for that matter), for it has profound ramifications for liberty.

A free-thinking people does not outsource thinking—the very business of life—to anyone.

UPDATE (2/25/024): Who knows what this means? Still, a nice category in which to be No. 1, in New Releases however fleetingly: Ethics & Morality.

UPDATE II (3/13/024): I’m buoyed to report that today, March 3, The Paleolibertarian Guide To Deep Tech, Deep Pharma & The Aberrant Economy is No. 31 in the category of “Best Sellers in Philosophy Criticism.”